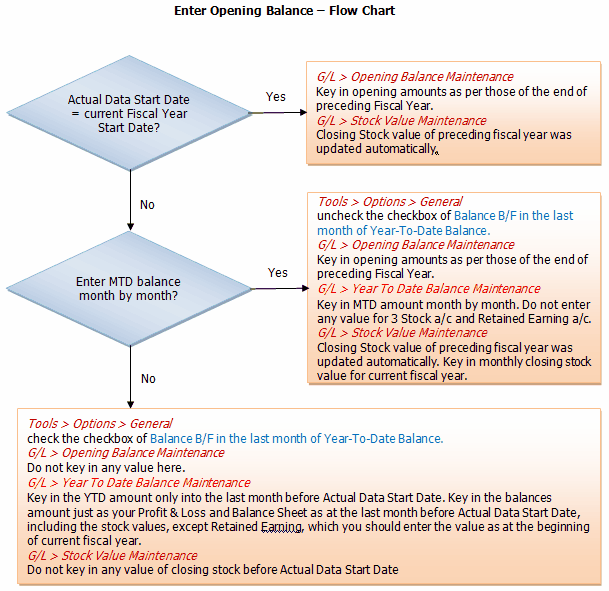

Enter Opening Balance - Flow Chart

Entering opening balance for general ledgers is necessary for a newly created account book, unless it is a newly formed company that does not carry any opening balance.

There are 3 ways of handling opening balances, depending on Actual Data Start Date and how would the user prefer in dealing with the balances before Actual Data Start Date when it is not the same as Current Fiscal Year Start Date.

Below are the 3 possible scenarios:

1. Actual Data Start Date = current Fiscal Year Start Date; it is the beginning of a new fiscal year; e.g. 01-01-2009

2. Actual Data Start Date (01-07-2009) ≠ current Fiscal Year Start Date (01-01-2009), the closing balance as at 31-12-2008 (previous fiscal year end date) is to be treated as opening balance at 01-01-2009, and MTD (Month-To-Date) balances for Jan 2009 ~ June 2009 will be keyed in month by month.

3. Actual Data Start Date (01-07-2009) ≠ current Fiscal Year Start Date (01-01-2009), the closing balance as at 30-06-2009 is to be treated as opening balance at 01-07-2009, and will be keyed in as YTD balance (in the column of June 2009 only).

The main differences between scenario 2 and scenario 3:

- it is more tedious for Scenario 2 because user needs to key in MTD amount month by month up to the last month before the Actual Data Start Date; while Scenario 3 needs only YTD amount as at the last month before the Actual Data Start Date.

- however, Scenario 2 can provide monthly comparison reports for the whole fiscal year; while Scenario 3 can only provide monthly comparison reports from the month of Actual Data Start Date and onwards.

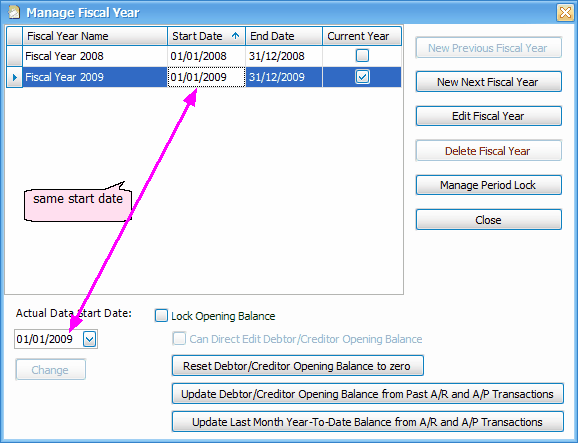

Scenario 1: Actual Data Start Date (01-01-2009) = current Fiscal Year Start Date (01-01-2009)

Go to Tools > Manage Fiscal Year

The Actual Data Start Date is set to the same as current Fiscal Year Start Date, which is 01-01-2009.

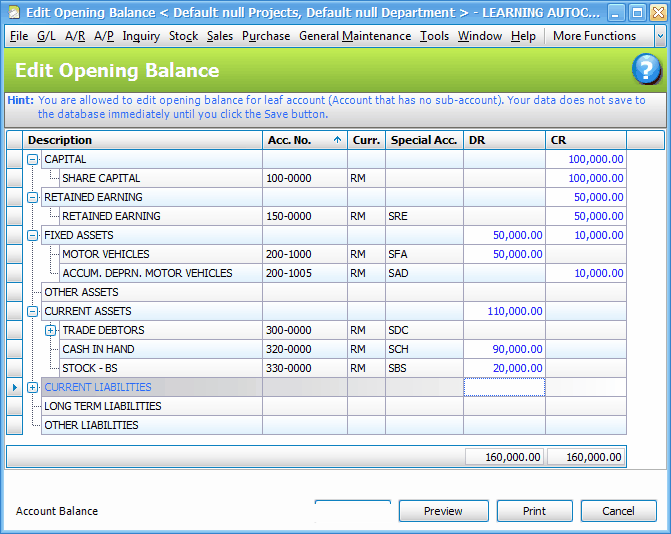

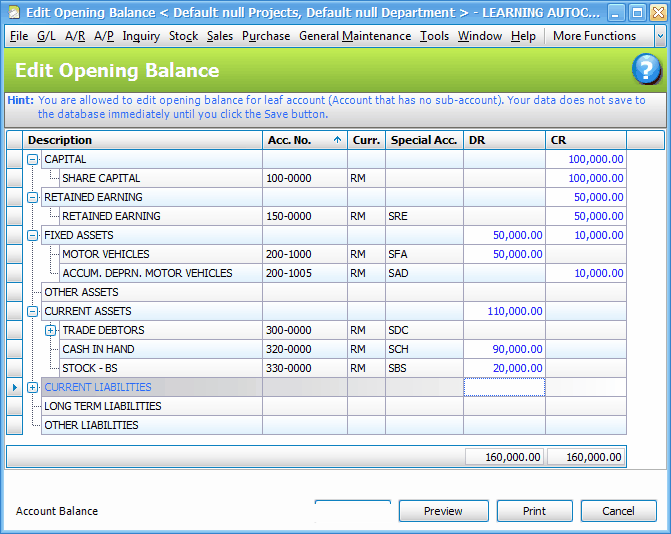

Go to G/L > Opening Balance Maintenance

Key in the opening balances (which was the closing balances as at 31-12-2008). You should notice that only Balance Sheet accounts are available, as Profit & Loss accounts are irrelevant.

Important Note

(This example assumed that there was no balances for debtors and creditors. In actual case if any of these personal accounts carries an outstanding balance, refer to details on How to enter opening balance balance - AR/AP )

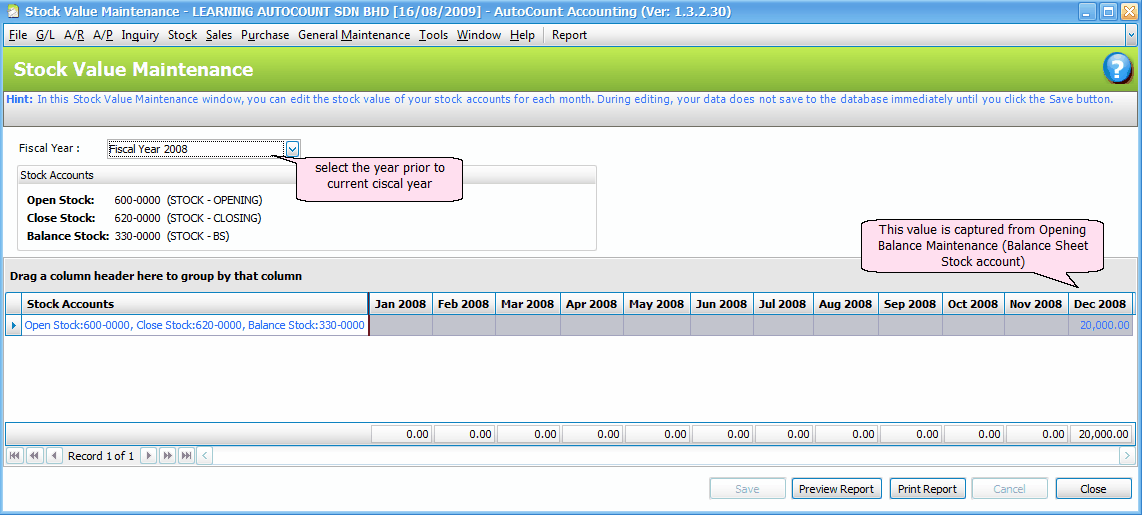

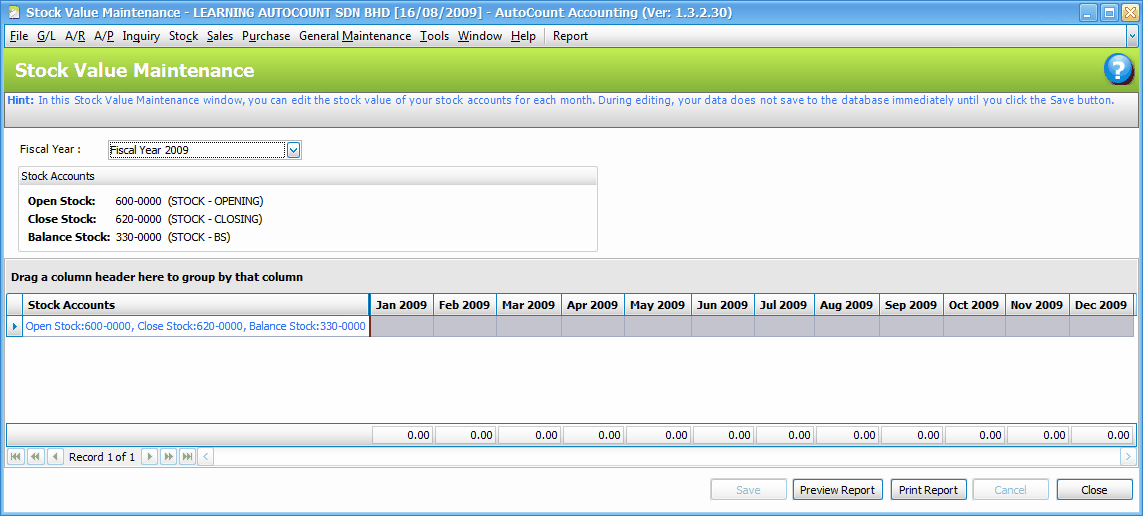

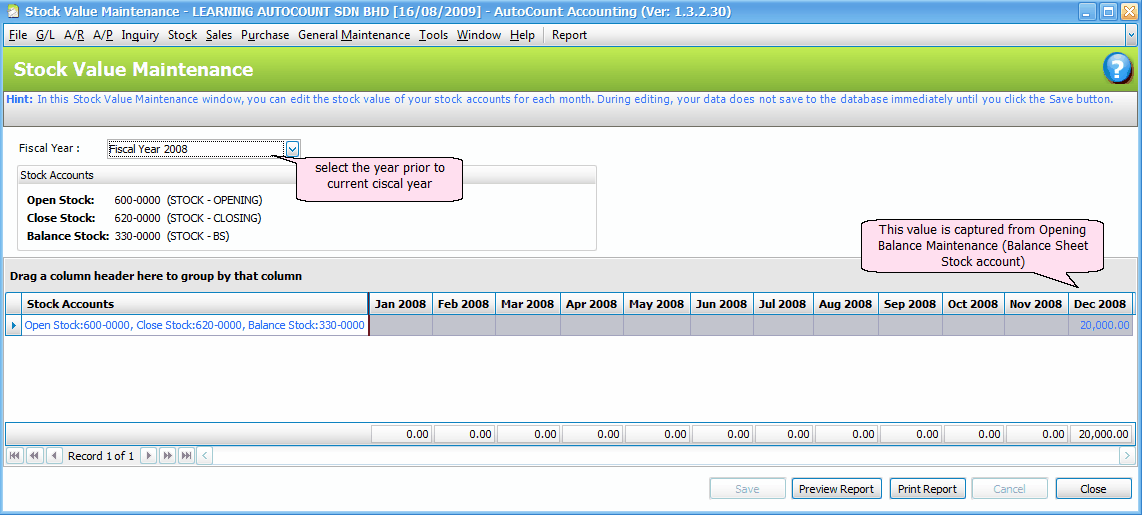

Go to G/L > Stock Value Maintenance

Select the previous fiscal year (Fiscal Year 2008), notice that the December closing stock is filled with 20,000. This amount is derived from the value keyed in Opening Balance Maintenance.

If you need to modify this value, do it at Opening Balance Maintenance.

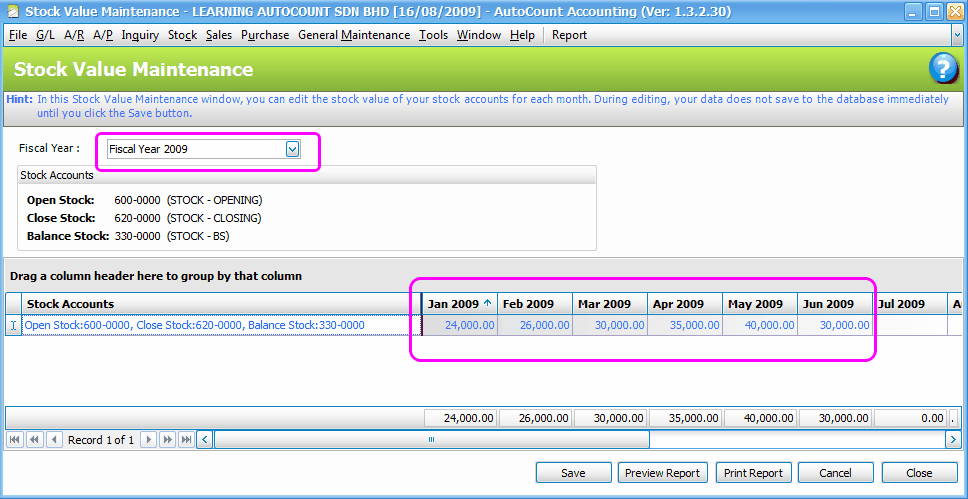

Change the fiscal year to current fiscal year (Fiscal Year 2009), here you may maintain the value of closing stock for each month in current fiscal year.

Scenario 2: Actual Data Start Date (01-07-2009) ≠ current Fiscal Year Start Date (01-01-2009)

MTD balance for Jan ~ Jun 2009 will be keyed in month by month

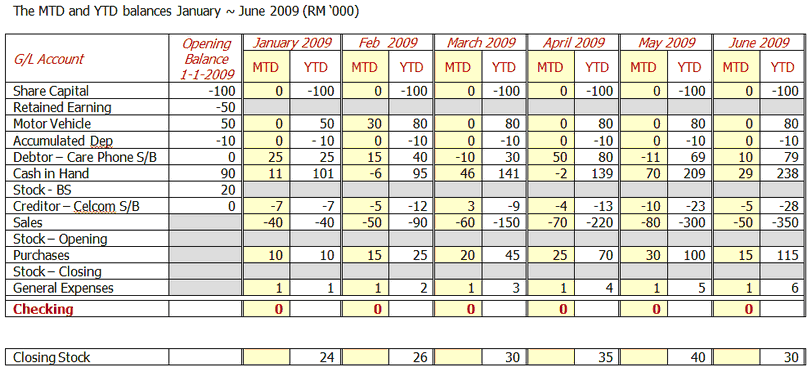

The following table provides MTD/YTD amount before Actual Data Start Date:

(amount '0' means no change.)

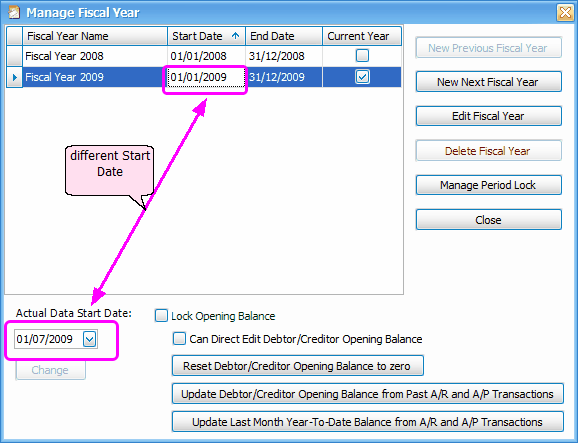

Go to Tools > Manage Fiscal Year

The Actual Data Start Date is set to 01-07-2009, which is not the same as current Fiscal Year Start Date 01-01-2009.

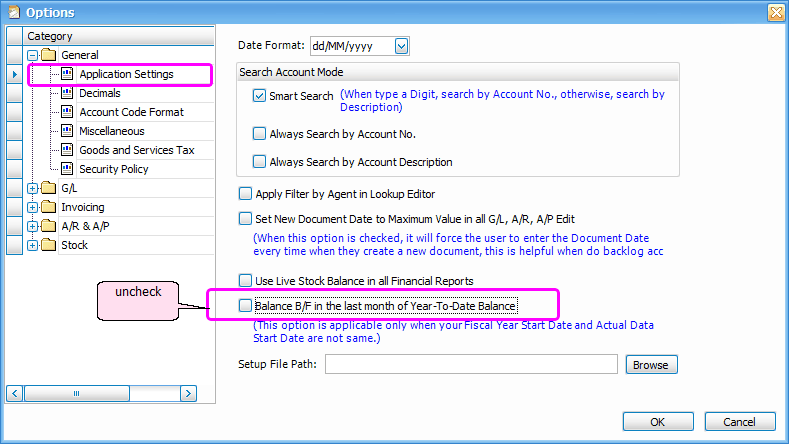

Go to Tools > Options

Look into General > Application Settings, uncheck the checkbox of Balance B/F in the last month of Year-To-Date Balance.

Go to G/L > Opening Balance Maintenance

Key in opening balances for current fiscal year at 01-01-2009 (which was closing balances as at 31-12-2008).

Important Note

(This example assumed that there was no balances for debtors and creditors. In actual case if any of these personal accounts carries an outstanding balance, refer to details on How to enter opening balance balance - AR/AP )

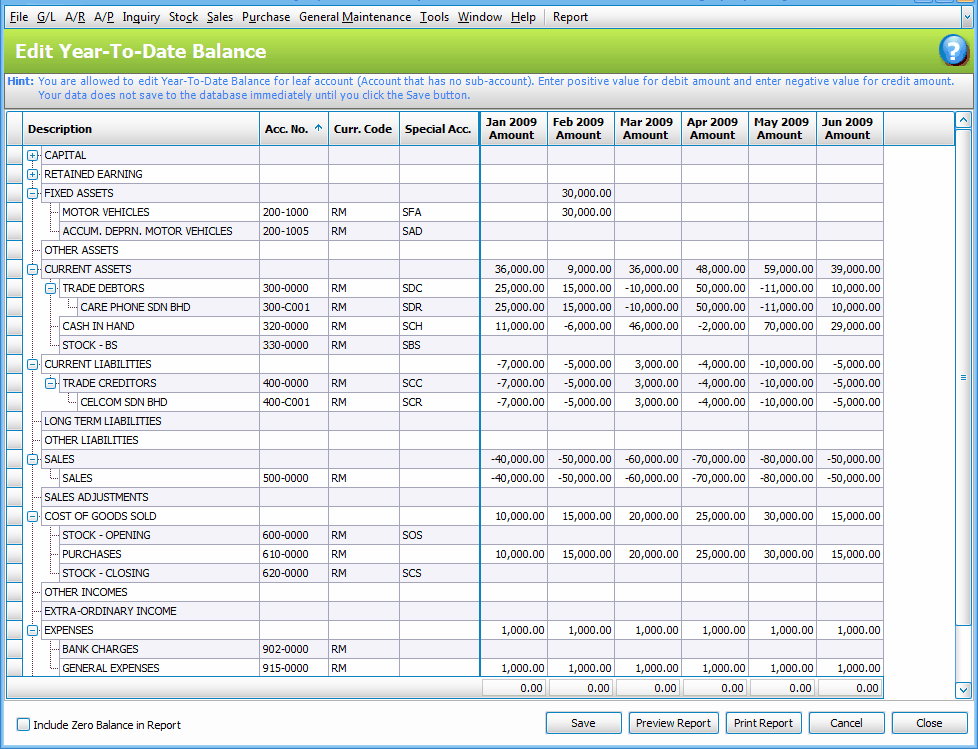

Go to G/L > Year To Date Balance Maintenance

Key in MTD amount into each month of January ~ June 2009.

Observe the following tips:

a. do not enter Stock value; stock value will be entered in Stock Value Maintenance.

b. do not enter value for Retained Earning; it will be calculated by the system.

c. basically, negative sign '-' means credit balance, positive means debit balance.

Note: For account types that are Credit in nature (such as Liability, Sales, Income, Capital, Accumulated Depreciation, Purchase Return ..), MTD balance with negative sign '-' will increase YTD balance. Thus a positive MTD balance will reduce YTD balance.

for account types that are Debit in nature (such as Asset, Expenses, Purchases, Sales Return..), MTD balance with negative sign '-' will reduce YTD balance. Thus a positive MTD balance will increase YTD balance.

Important Note

(The increase and reduce of MTD balance of each personal account (creditor/debtor) is the summary of invoices, CNs and cash payments for that month. To maintain opening balance of each personal account,refer to details on How to enter opening balance balance - AR/AP )

Go to G/L > Stock Value Maintenance

Select the previous fiscal year (Fiscal Year 2008), notice that the December closing stock is filled with 20,000. This amount is derived from the value keyed in Opening Balance Maintenance.

If you need to modify this value, do it at Opening Balance Maintenance.

Change the fiscal year to current fiscal year (Fiscal Year 2009), here you may maintain the value of closing stock for each month of January ~ June 2009, and the rest of months in current Fiscal Year.

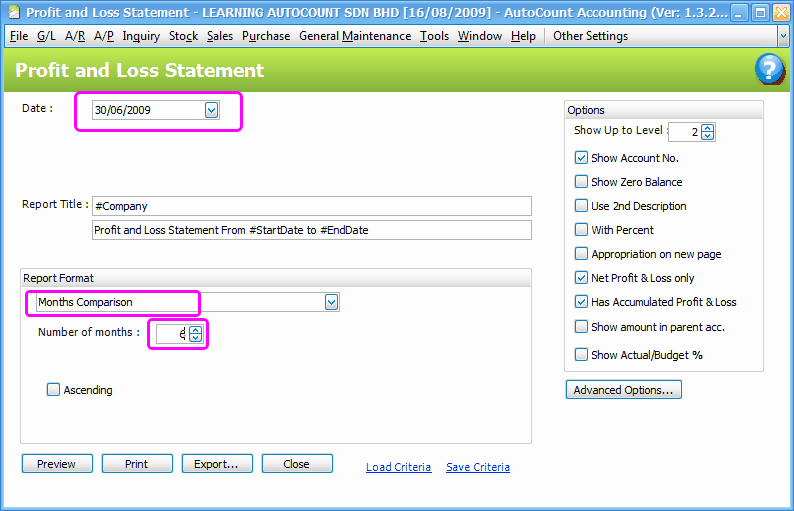

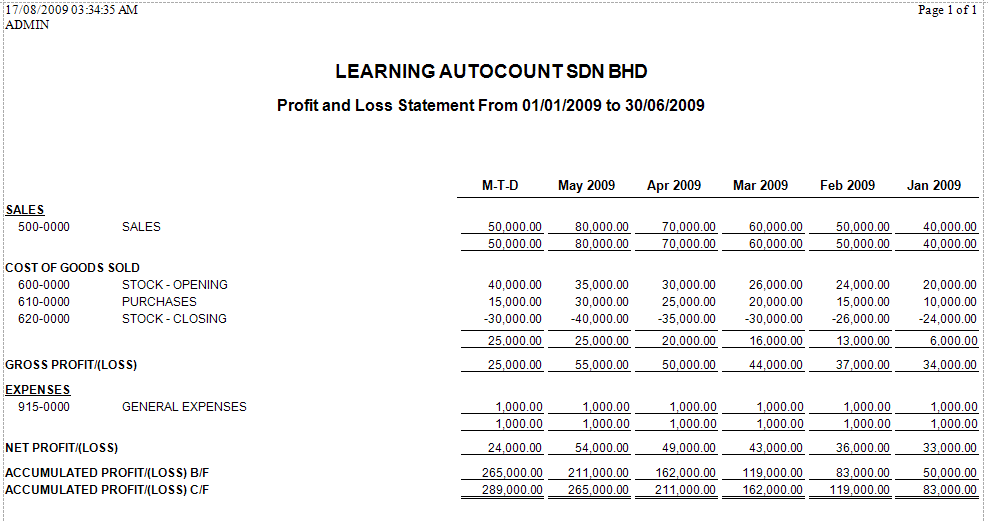

Go to G/L > Profit and Loss Statement

Let's view the monthly comparison report.

Select the date (30/06/2009), report format (Months Comparison) and Number of months (6)....

Click on Preview;

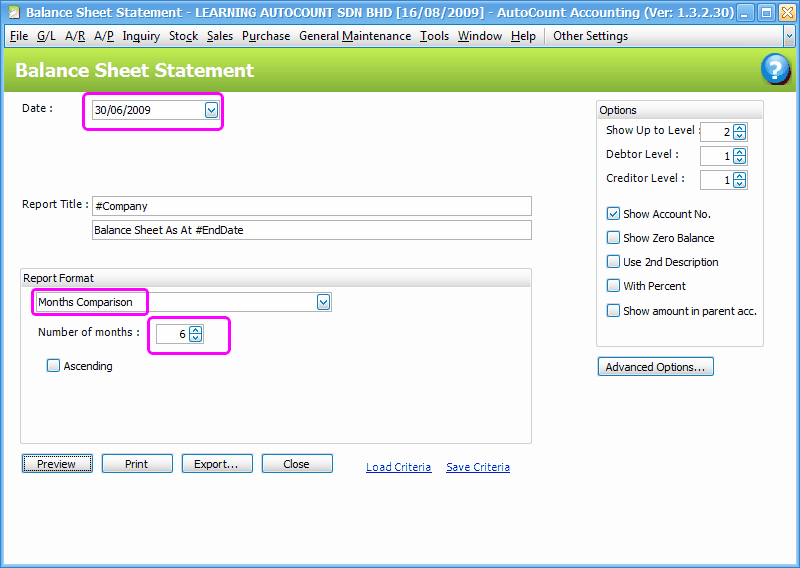

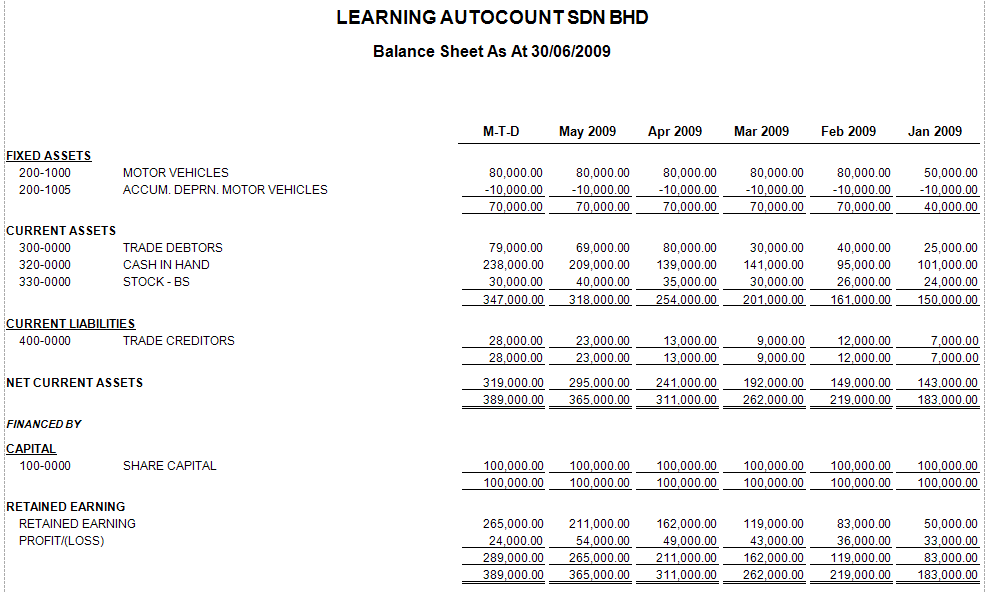

Go to G/L > Balance Sheet Statement

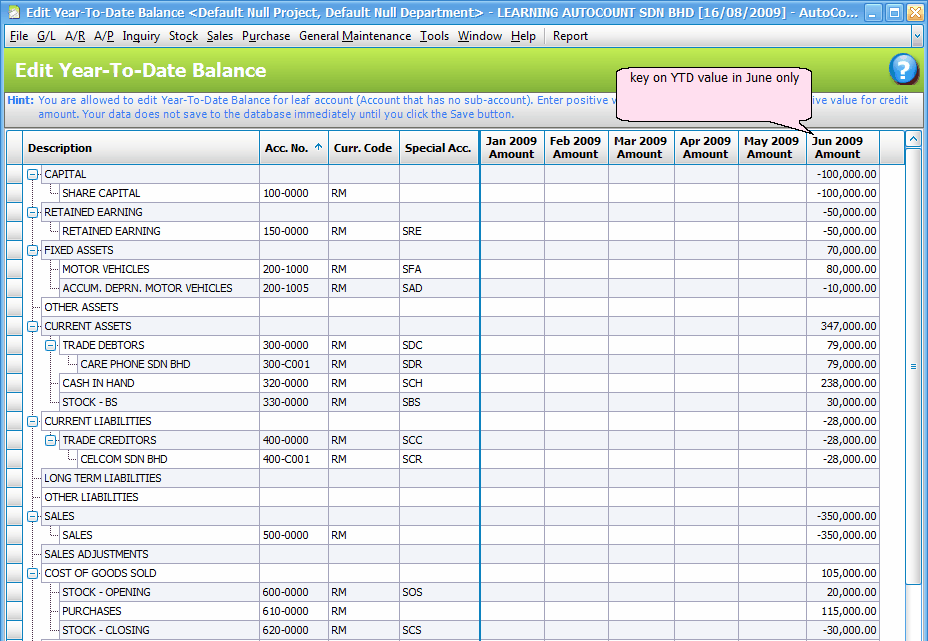

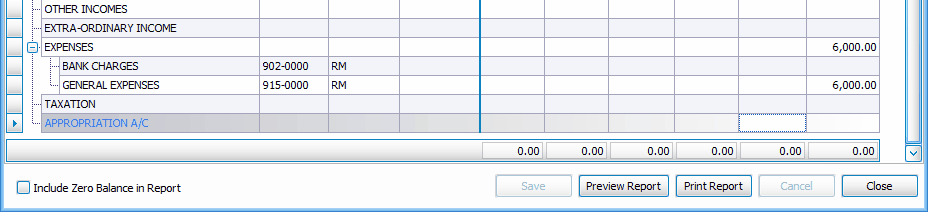

Scenario 3: Actual Data Start Date (01-07-2009) ≠ current Fiscal Year Start Date (01-01-2009)

The total balance for Jan ~ Jun 2009 will be keyed in month of June 2009 as YTD balance.

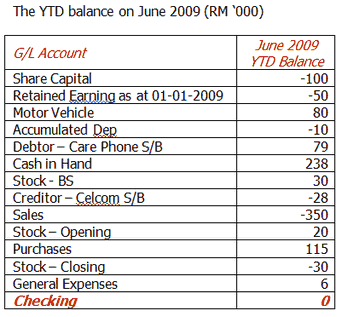

The following table provides the YTD balance of June 2009, before the Actual Data Start Date:

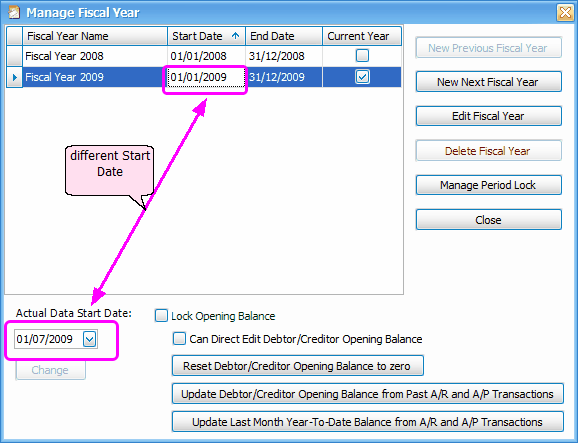

Go to Tools > Manage Fiscal Year

Actual Data Start Date is set to 01-07-2009, which is not the same as current Fiscal Year Start Date 01-01-2009.

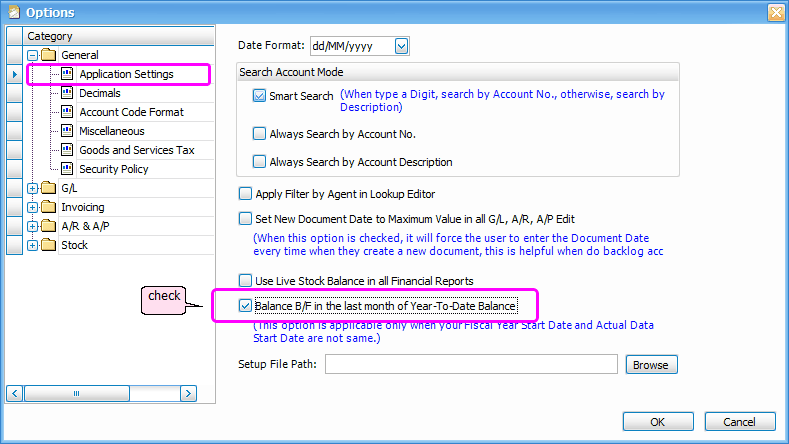

Go to Tools > Options

Look into General > Application Settings, check the checkbox of Balance B/F in the last month of Year-To-Date Balance.

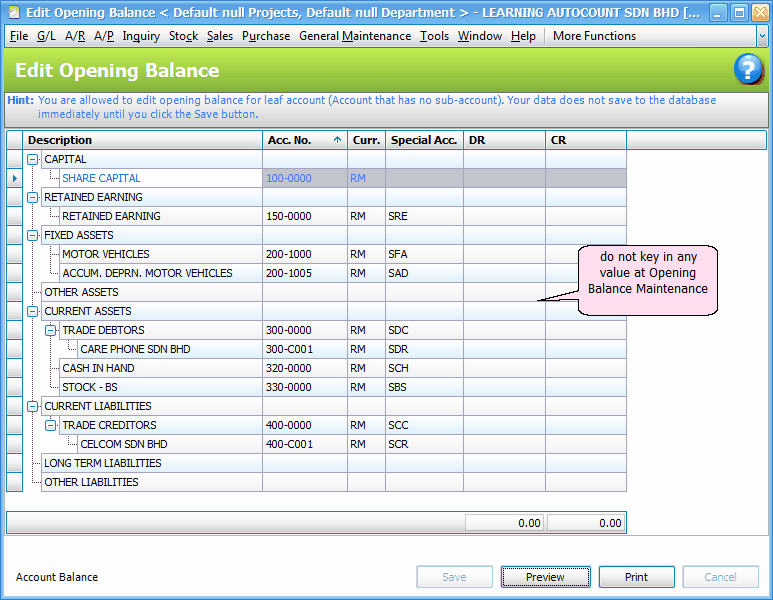

Go to G/L > Opening Balance Maintenance

Do not key in any amount here.

Go to G/L > Year To Date Balance Maintenance

Key in YTD amount into June 2009 only.

Observe the following tips:

a. enter balance amount just as your Profit & Loss and Balance Sheet as at 30 June 2009, including Stock value, except Retained Earning (refer to note b.)

b. for Retained Earning, enter the value as at beginning of current fiscal year, current year Retained Earning (YTD) will be calculated by the system.

c. basically, negative sign '-' means credit balance, positive means debit balance.

Important Note

YTD balance of each personal account (creditor/debtor) must match the opening balance of each personal account as well in A/R and A/P menus, refer to details on How to enter opening balance balance - AR/AP )

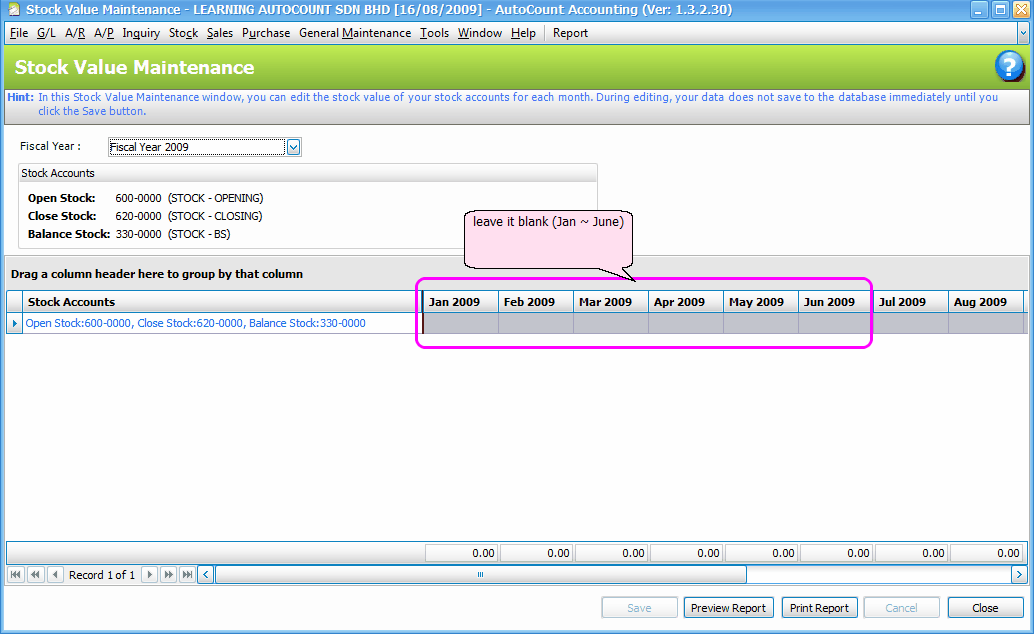

Go to G/L > Stock Value Maintenance

Select the previous fiscal year (Fiscal Year 2008), notice that the December closing stock is empty. Do not key in any amount here.

Change the fiscal year to current fiscal year (Fiscal Year 2009), Do Not key in any value for month of January ~ June 2009. Key in closing stock value only on or after July 2009.

_____________________________________________________________

Send feedback about this topic to AutoCount. peter@autocountSoft.com

© 2010 Auto Count Sdn Bhd - Peter Tan. All rights reserved.