This is used to reconcile the system's record on Bank accounts against Bank Statements received from banks, and eventually produce Bank Reconciliation Statements.

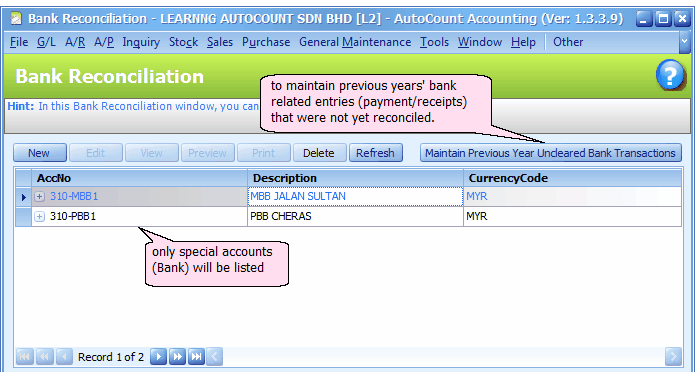

Go to G/L > Bank Reconciliation

A list of bank accounts will be shown:

Maintain Previous Year Uncleared Bank Transactions

Highlight a bank account, click on the button of ![]()

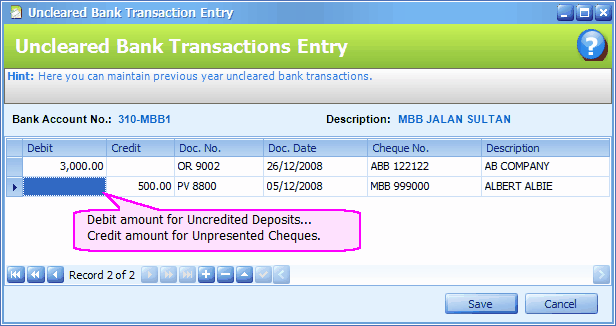

Here you can add records of uncleared bank entries (not yet reconciled) prior to current fiscal year so that they can be reconciled later. This one-time-only step is necessary for current fiscal year of a new account book (except for a new company) as the system did not have these records.

Click on '+' to add entries with dates earlier than current fiscal year.

Click on Save.

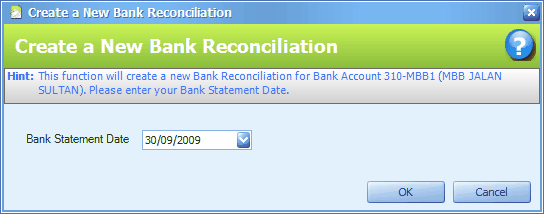

Add New Bank Reconciliation

Highlight a bank account, click on Add,

Define the Bank Statement Date,

Click on OK.

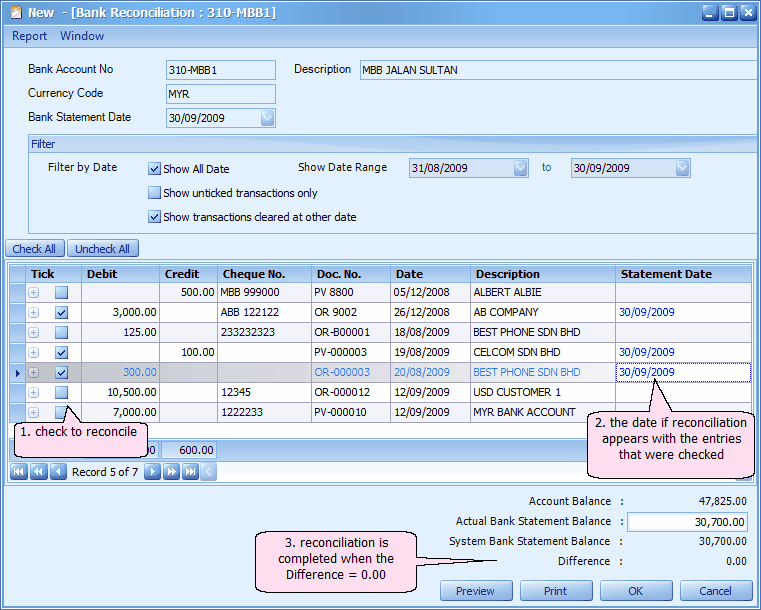

Bank Account No.: account number of the selected bank account.

Description: description of the bank account

Currency Code: currency code of the bank account

Bank Statement Date: the date defined in preceding step

Show All Date: check this checkbox so that all entries will be shown regardless of entries date; uncheck this if you want to specify the date range.

Show Date Range: uncheck Show All Date so that you may define the date range of entries

Show unticked transactions only: to hide the checked entries

Show transactions cleared at other date: to display all entries that were reconciled in other date

Account Balance: current balance amount of this bank account

Actual Bank Statement Balance: key in this balance amount as printed on bank statement (closing balance)

System Bank Statement Balance: balance amount of reconciled bank account (detected by the system); this amount will change when you start reconcile (tick the check-boxes). If all the entries are reconciled (ticked), this amount should be the same as Account Balance. In case of the first month of reconciliation, this balance is = Opening Bank Balance + / - the Uncleared Transaction (+Credit amount and - Debit amount), and it should be the same as the closing Balance of previous month's bank statement.

Difference: difference between Actual Bank Statement Balance and System Bank Statement Balance; this amount should be zero (0.00) if the entries are correctly reconciled.

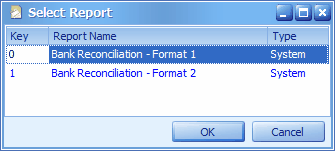

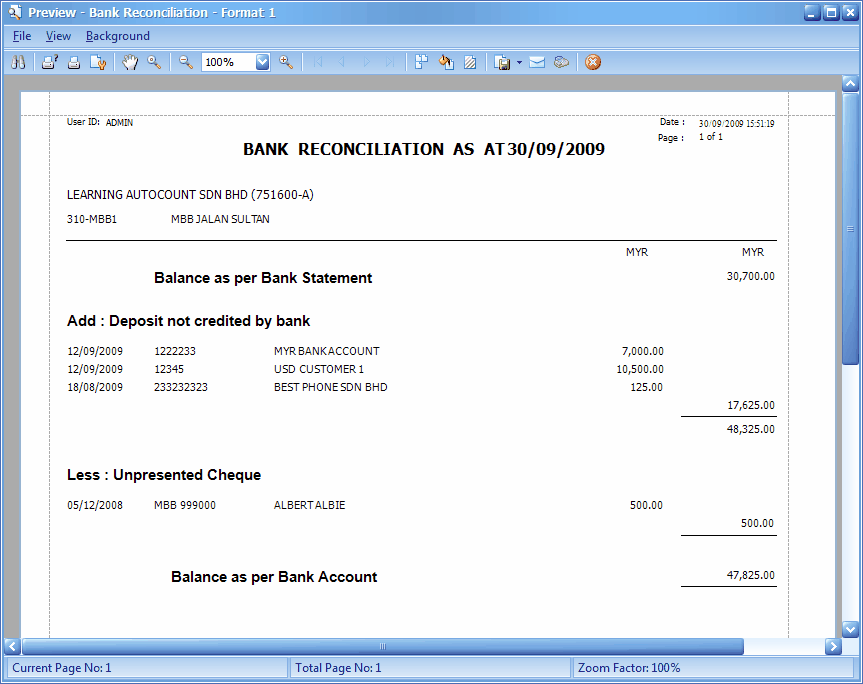

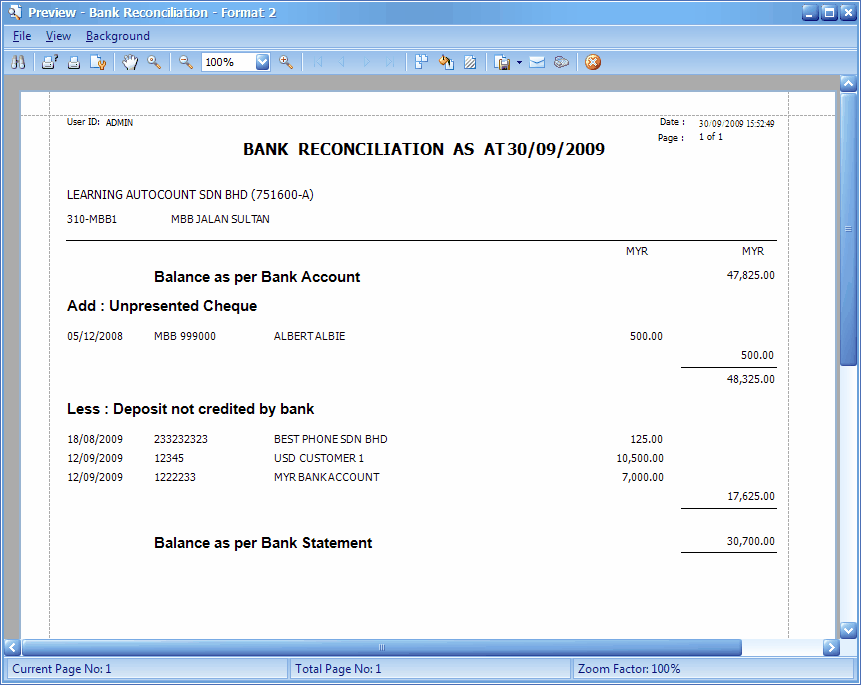

Click on Preview,

Format 1 starts with Balance as per Bank Statement and ends with Balance as per Bank Account.

Format 2 starts with Balance as per Bank Account and ends with Balance as per Bank Statement.

Also see Bank Slip.

_____________________________________________________________

Send feedback about this topic to AutoCount. peter@autocountSoft.com

© 2010 Auto Count Sdn Bhd - Peter Tan. All rights reserved.