This module allows revaluation of foreign currency and unrealized gain/loss in foreign currency.

Go to Tools > Program Control > Module Setting

Check the checkbox of Advanced Multi Currency to enable it.

Add A/R Invoice with Foreign Currency

Before all, let's say I have added an A/R Invoice for USD 4,000 (at the rate of 3.5000).

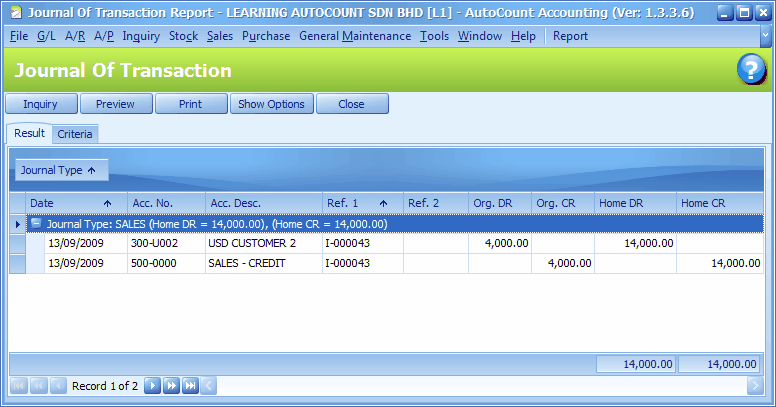

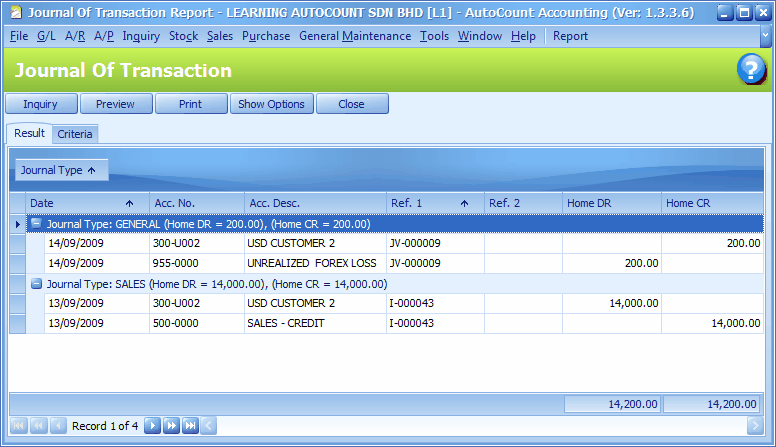

Go to G/L > Journal Of Transaction

Define filter options,

Click on Inquiry,

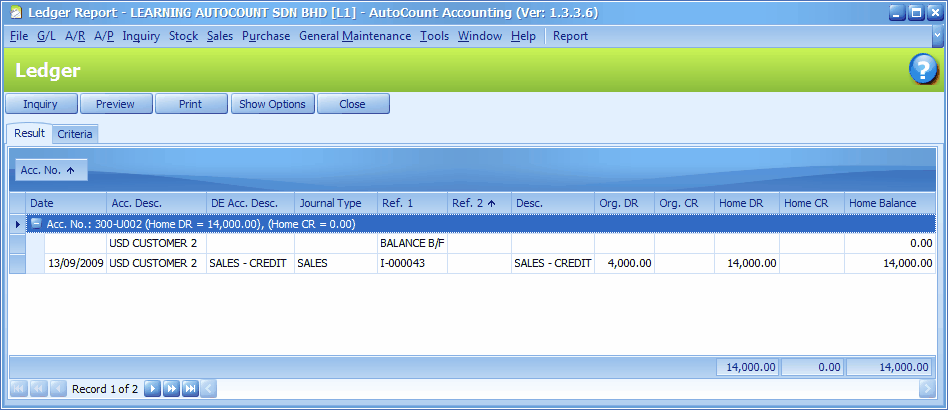

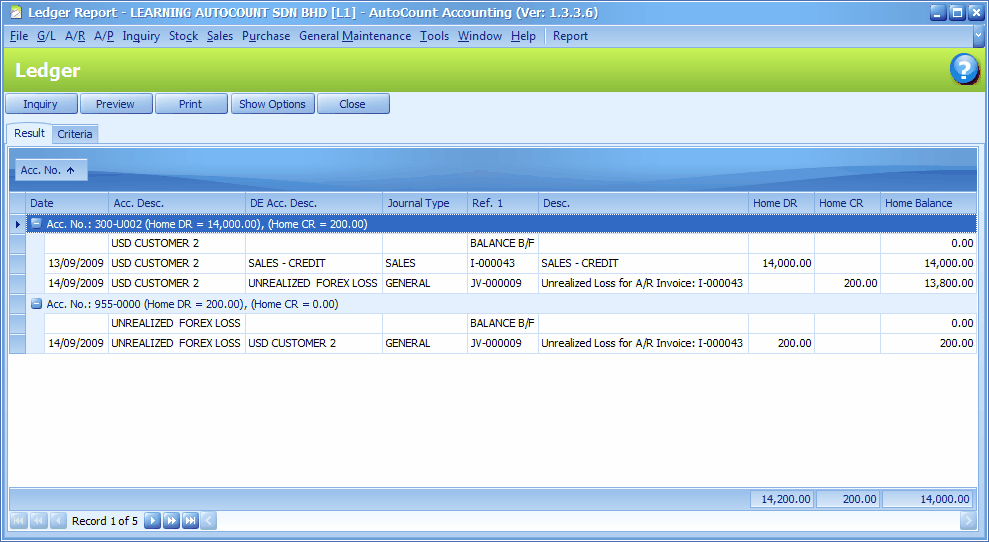

Go to G/L > Ledger Reports,

Define filter options and click on Inquiry,

Foreign Currency Revaluation

This is to revaluate all outstanding transaction in foreign currency, and to find out if there is any unrealized gain/loss according to current exchange rate. Each revaluation will auto generate journal entries should there is unrealized gain/loss. The last revaluation rate will be recognised and compared with subsequent revaluation or payments.

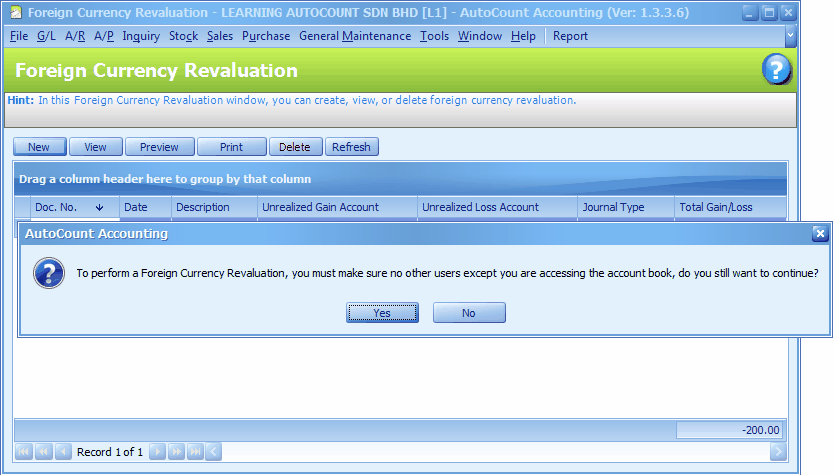

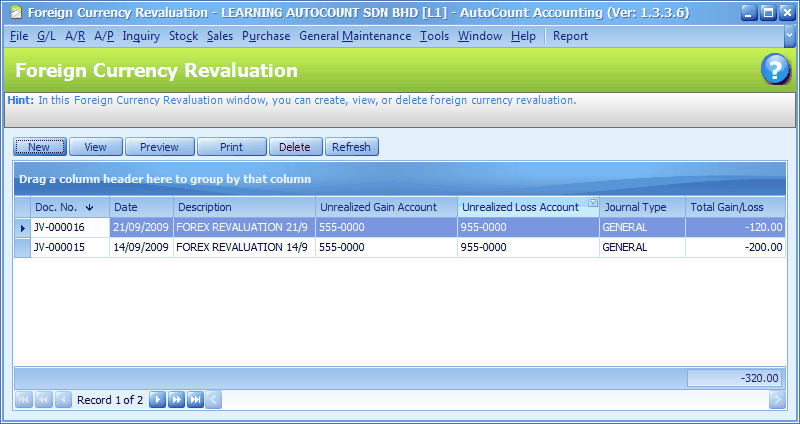

Go to G/L > Foreign Currency Revaluation

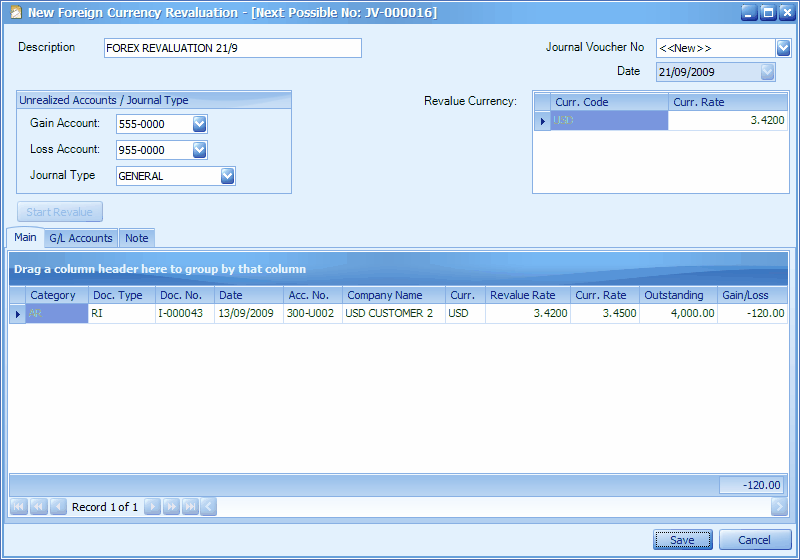

Click on New,

Click on Yes

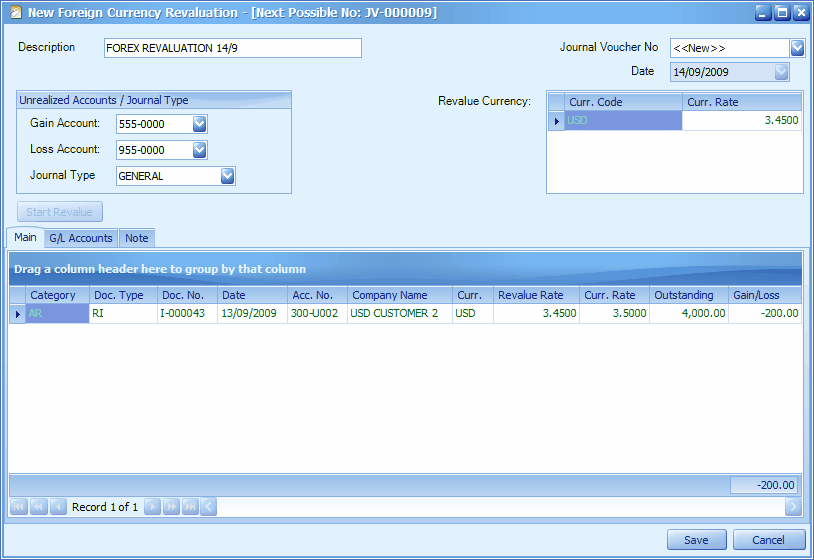

Key in Description, assign G/L accounts and journal type,

Confirm the date and revaluation currency rate,

Click on Start Revalue...

Description: define description for journal entries

Unrealized Account/Journal Type: assign respective G/L account for posting purpose.

Journal Voucher No: this number is auto-run. However you may click on the field to key in any voucher number.

Date: date of revaluation

Revalue Currency: key in the latest rate on the date of revaluation

Start Revalue: click on this button to execute the revaluation

Main tab: this page will list down related bills info and amount of unrealized gain/loss (right-most column) based on revaluation date and rate. Only outstanding bill will be listed, those already knocked off will not be listed.

G/L Accounts tab: this page will list down foreign-currency accounts (general ledger accounts), home balance and amount of unrealized gain/loss (right-most column) based on revaluation date and rate.

After Saved;

(1) The revaluation is not allowed to edit. You may only view, print or delete the revaluation.

(2) Journal Entry will be auto-generated should there was unrealized gain/loss.

(3) Not allowed to edit or delete transactions (in foreign currency) prior to the date of revaluation.

(4) The revaluation rate will be recognised as the last currency rate, and will be referred to

- in subsequent revaluation to compare with the then current rate, to derived at another unrealized gain/loss (if any).

- in subsequent payment to compare with the then exchange rate, to derived at the Gain/Loss on Foreign Exchange.

Click on Save, Close...

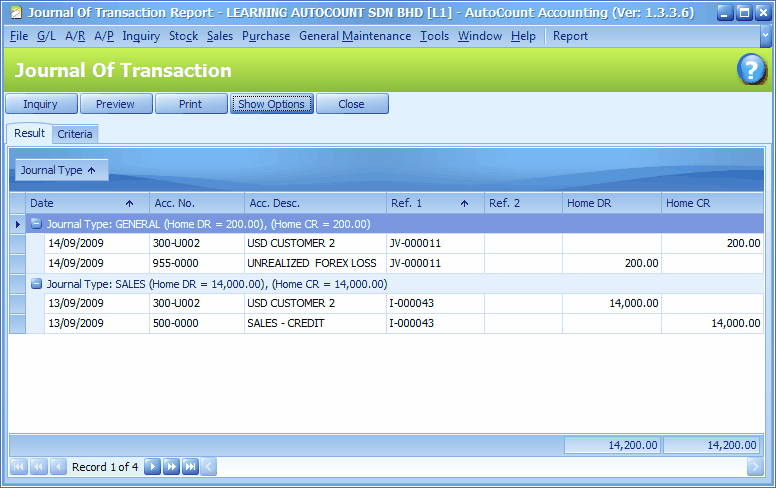

Go to G/L > Journal Of Transaction

Define filter options,

Click on Inquiry,

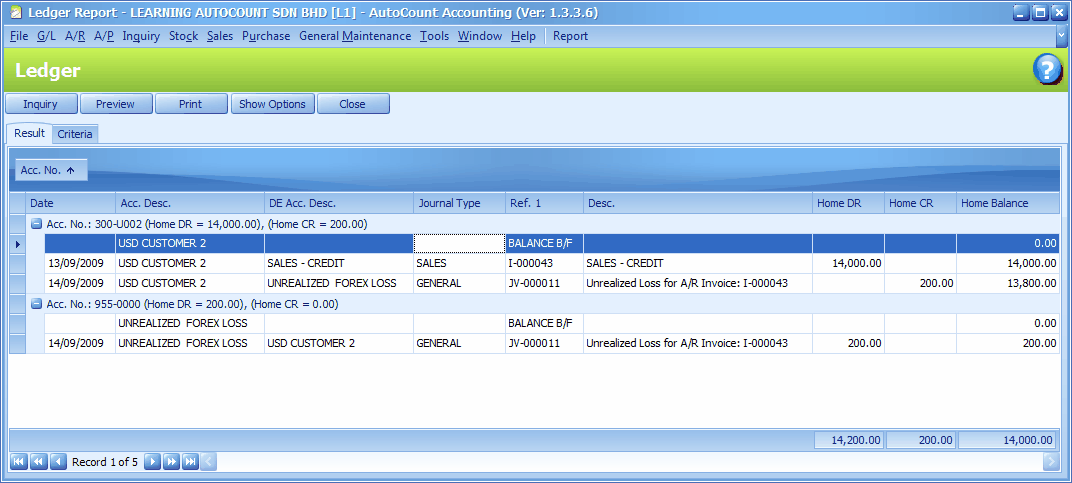

Go to G/L > Ledger Reports,

Define filter options and click on Inquiry,

Subsequent Revaluation

Let say the subsequent revaluation took place after one week, and the currency rate for USD is: 3.4200 ;

Go to G/L > Foreign Currency Revaluation

Click on New, Yes,

As compared to previous revaluation (at the rate of 3.4500), new Revaluation Rate (3.4200) caused a Unrealized Loss of 120.00

Click on Save, Close..

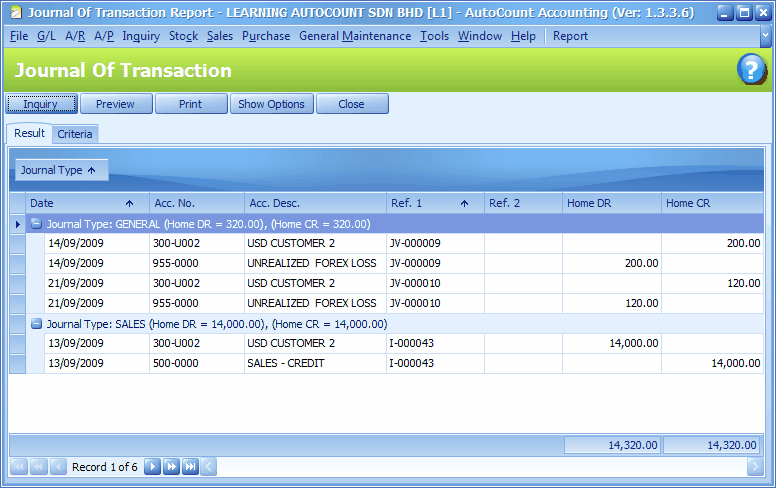

Go to G/L > Journal Of Transaction

Define filter options,

Click on Inquiry,

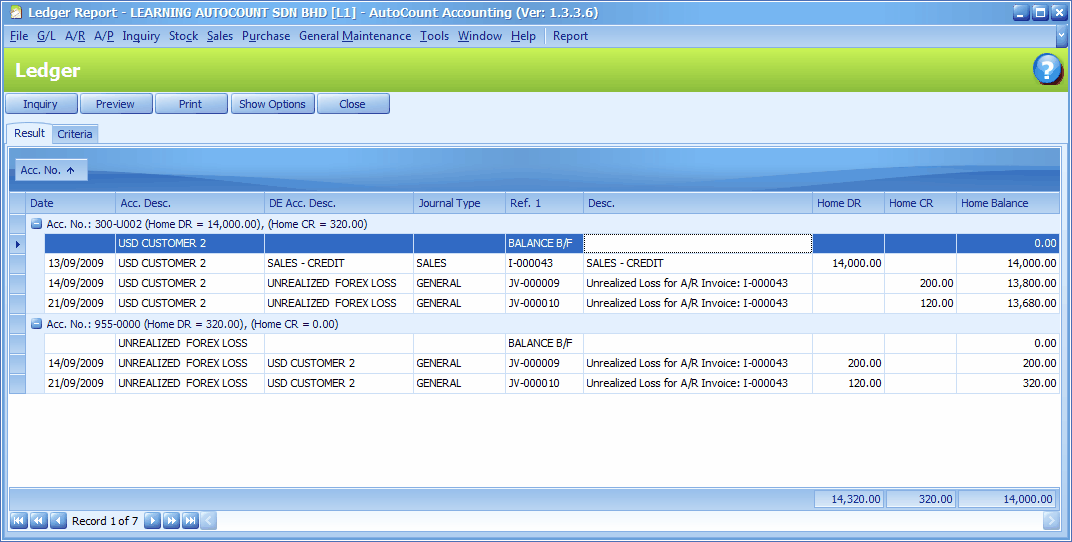

Go to G/L > Ledger Reports,

Define filter options and click on Inquiry,

Unrealized Gain/Loss

This is the same as Foreign Currency Revaluation, which is to revaluate all the outstanding transactions in foreign currency, and to find out if there is any unrealized gain/loss according to current exchange rate.

The difference is: each revaluation will also auto generate the journal entries should there is unrealized gain/loss, but the entries will be reversed on the next day; which means the original (initially traded) exchange rate will remain and be recognised and compared with the subsequent revaluation or payments.

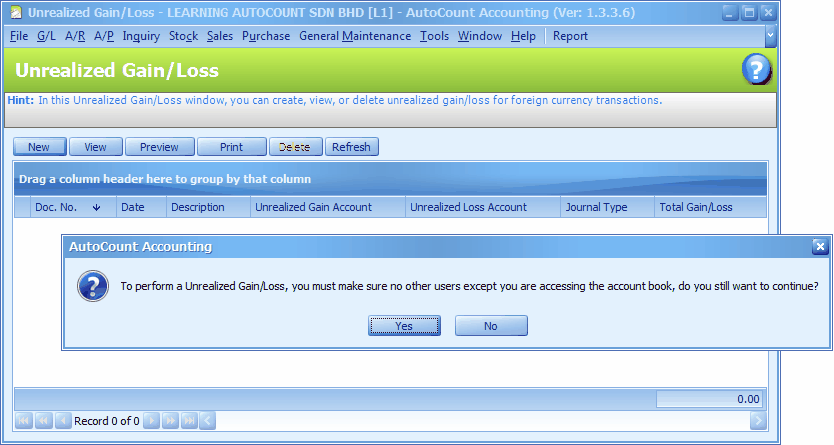

Go to G/L > Unrealized Gain/Loss

Click on New,

Click on Yes,

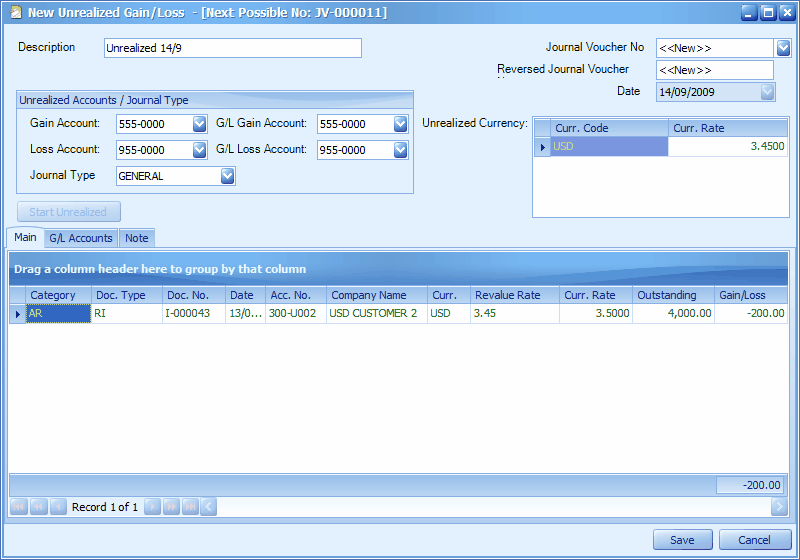

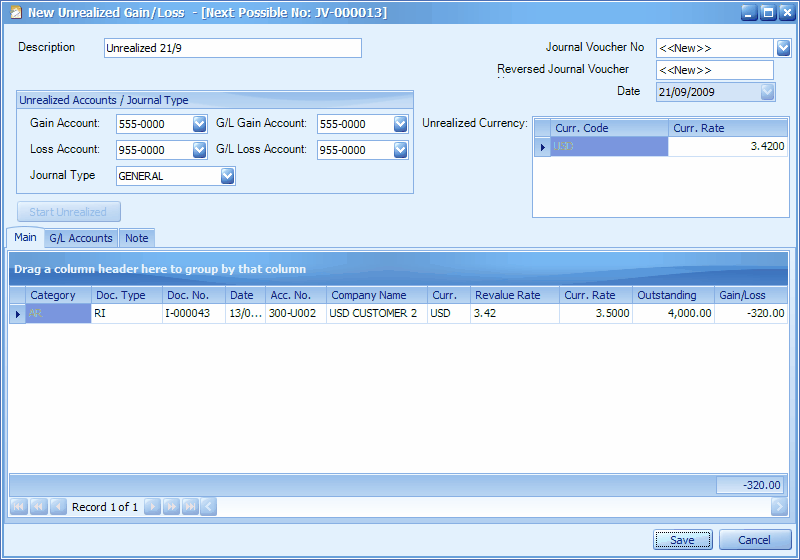

Key in Description, assign G/L accounts and journal type,

Confirm the date and unrealized currency rate,

Click on Start Unrealized...

(please note that the date is 14/09/2009)

Description: define a description for journal entries

Unrealized Account/Journal Type: assign the respective Gain/Loss Accounts for posting purpose (sales/purchase ledger). Both G/L Gain/Loss Accounts are used for G/L Accounts tab (general ledger accounts).

Journal Voucher No: this number is auto-run. However you may click on the field to key in any voucher number.

Reversed Journal Voucher No: this number is auto-run. However you may click on the field to key in any voucher number.

Date: the date of unrealized.

Unrealized Currency: key in the latest rate on the date of unrealized

Start Unrealized: click on this button to execute the unrealized

Main tab: this page will list down related bills info and amount of unrealized gain/loss (right-most column) based on unrealized date and rate. Only outstanding bill will be listed, those already knocked off will not be listed.

G/L Accounts tab: this page will list down foreign-currency accounts (general ledger accounts), home balance and amount of unrealized gain/loss (right-most column) based on unrealized date and rate.

After Saved;

(1) (for one day) the unrealized is not allowed to edit. You may only view, print or delete the revaluation.

(2) Journal Entry will be auto-generated should there was unrealized gain/loss. The reversed entries will be auto-generated on the following day. The original exchange rate will be restored.

Click on Save, Close...

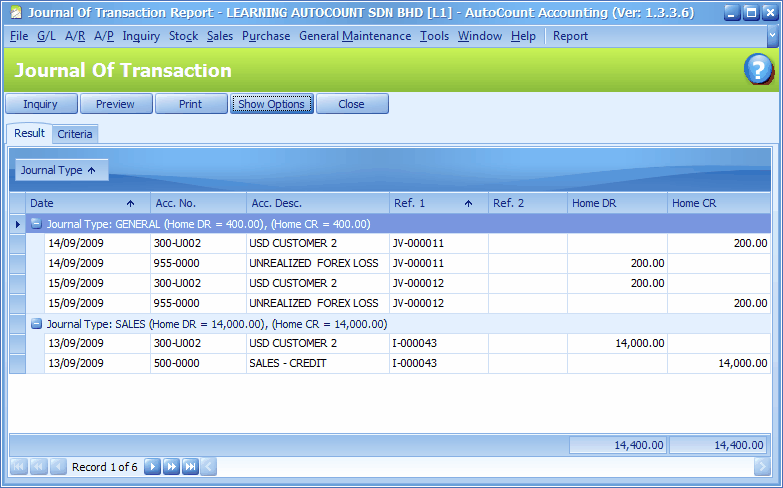

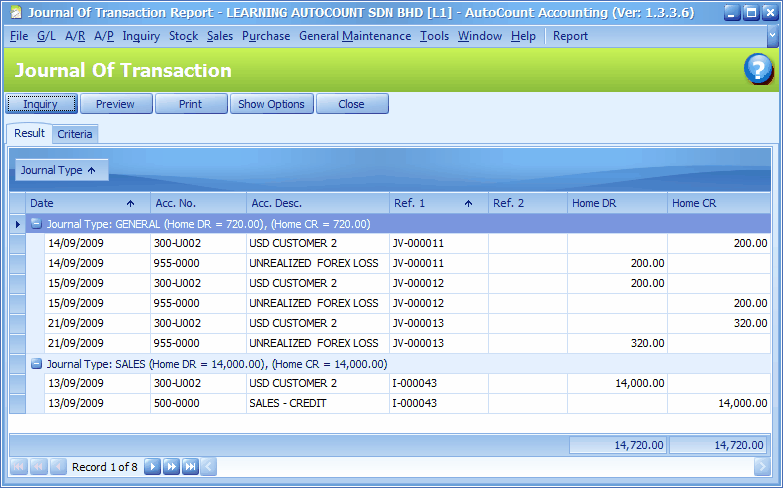

Go to G/L > Journal Of Transaction

Define filter options, (filter the date till 14/09/2009)

Click on Inquiry,

Define filter options, (filter the date till 15/09/2009)

Reversed entries is generated..

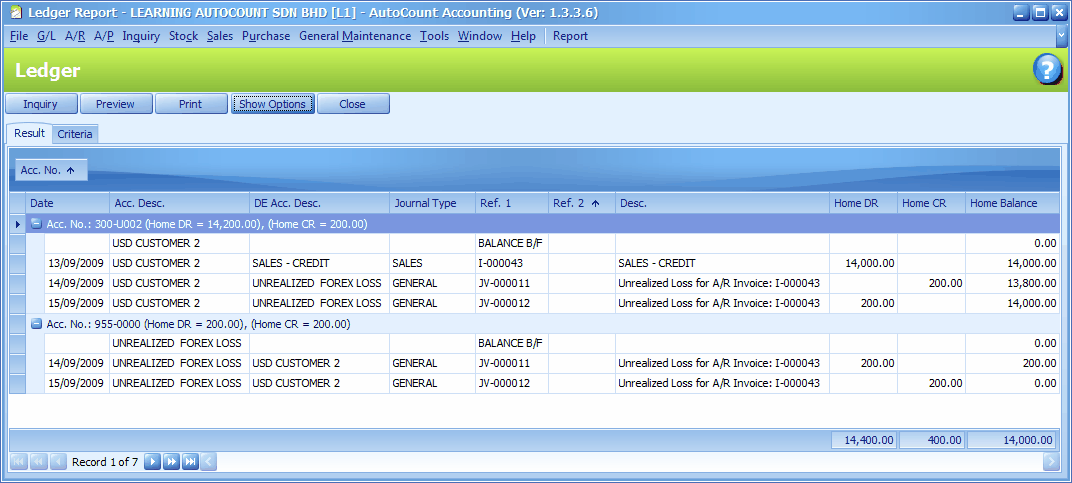

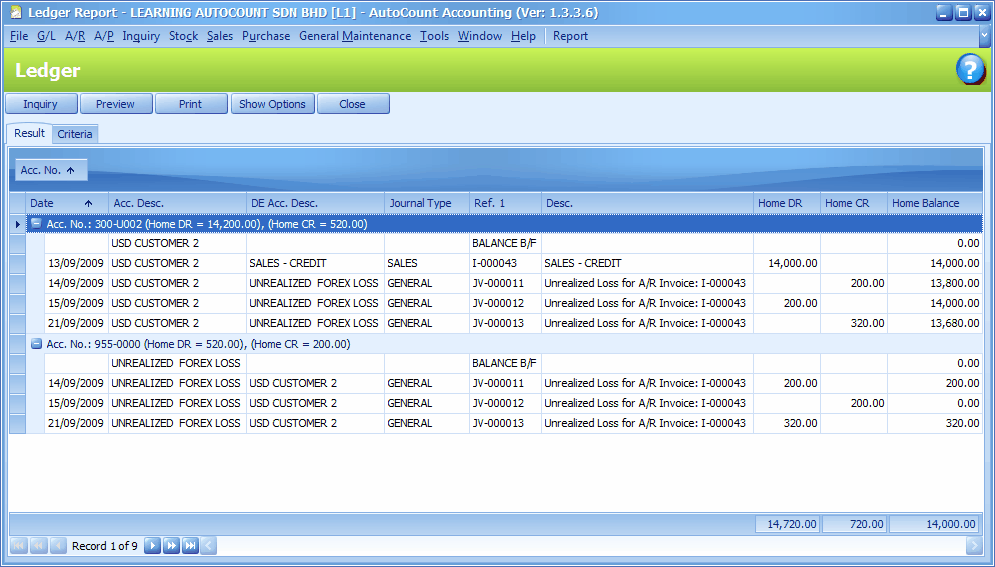

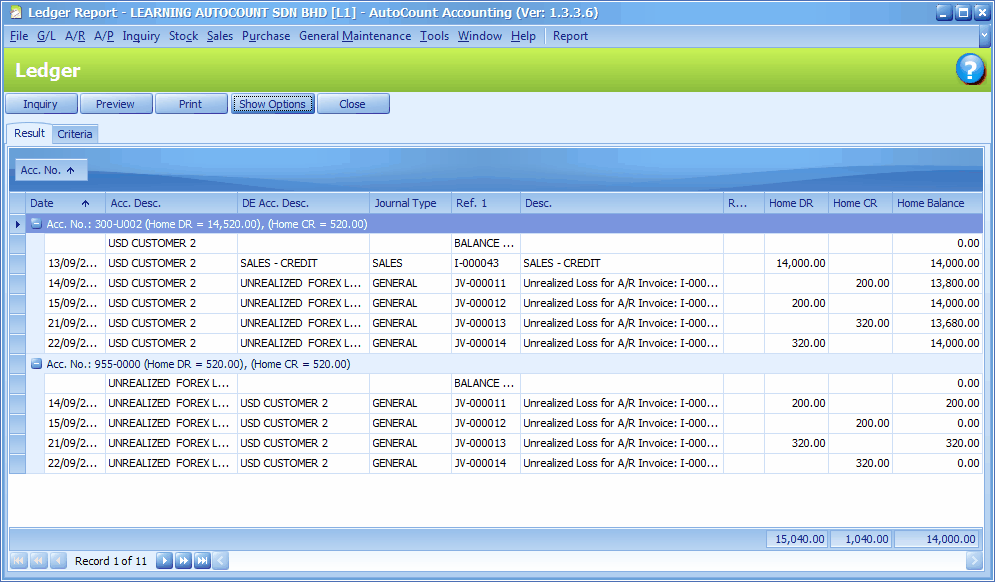

Go to G/L > Ledger Reports,

Define filter options and click on Inquiry,

(filter the date till 14/09/2009)

(filter the date till 15/09/2009)

Subsequent Revaluation

Let say the subsequent revaluation took place after one week, and the currency rate for USD is: 3.4200 ;

Go to G/L > Unrealized Gain/Loss

Click on New, Yes,

Key in Description, assign G/L accounts and journal type,

Confirm the date and unrealized currency rate,

Click on Start Unrealized...

(please note that the date is 21/09/2009)

Click on Save, Close...

Go to G/L > Journal Of Transaction

Define filter options, (filter the date till 21/09/2009)

Click on Inquiry,

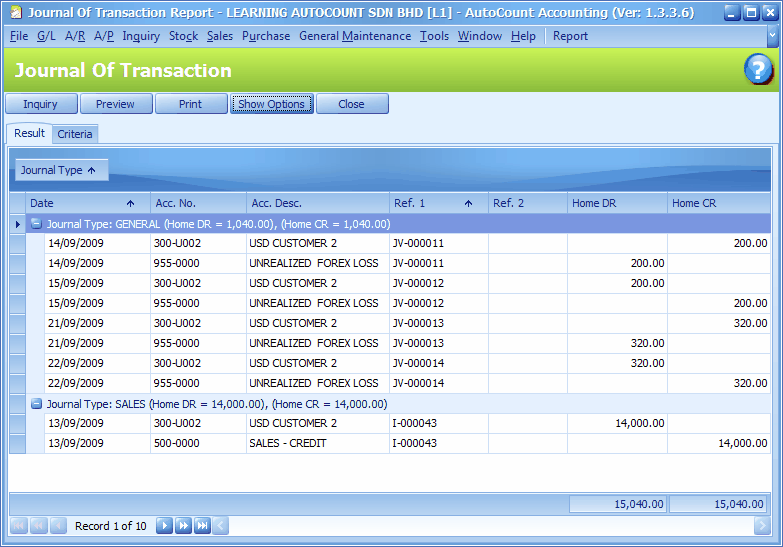

Define filter options, (filter the date till 22/09/2009)

Reversed entries is generated..

Go to G/L > Ledger Reports,

Define filter options and click on Inquiry,

(filter the date till 21/09/2009)

(filter the date till 22/09/2009)

_____________________________________________________________

Send feedback about this topic to AutoCount. peter@autocountSoft.com

© 2010 Auto Count Sdn Bhd - Peter Tan. All rights reserved.